The Rise of Offline Code Scanning Payments in China (2020–2027)

Introduction

QR Code Statistics: In today’s digital world, QR codes are becoming very popular. Businesses and individuals are using these codes more and more, leading to a global increase in their use. It’s important to understand how QR codes work and their benefits to see why they’re being adopted so widely. QR codes, or Quick Response codes, are two-dimensional barcodes that can be scanned with a smartphone or a special QR code reader.

These codes can store information like website links, contact info, or other types of data. The ease of scanning a QR code makes it handy for both businesses and customers. Because of this, many businesses are taking advantage of QR codes for various uses. We shall shed more light on QR Code Statistics through this article.

In the past decade, China has transformed into a near-cashless society, and at the heart of that transformation is offline code scanning payment technology—primarily in the form of QR code-based transactions.

From small street vendors to luxury malls, scanning a code to pay has become second nature for consumers and merchants alike. As we look at the evolution from 2020 through to 2027, it’s clear that this trend isn’t just continuing—it’s becoming a foundation of China’s retail and financial ecosystem.

Market Overview

In recent years, China has transformed into one of the world’s most advanced cashless societies. What began as a trend among urban youth has now evolved into a nationwide phenomenon that encompasses every facet of daily life. The near-total adoption of mobile payments in China represents more than just a shift in financial habits; it signifies a profound cultural and technological change that is reshaping how people live, interact, and even think about money.

At the heart of China’s cashless transformation are two dominant mobile payment platforms: Alipay, operated by Ant Group, and WeChat Pay, a feature within Tencent’s ubiquitous social media app WeChat. These two services have become so deeply embedded in Chinese life that carrying physical cash is now rare in most cities. Whether purchasing groceries, paying rent, ordering food delivery, or even donating to a street performer, users simply scan or display a QR code to complete a transaction. This system is not limited to large cities—mobile payments have also penetrated rural areas, making digital finance accessible to virtually everyone with a smartphone.

Mobile payments are used for nearly every daily activity. Street vendors, taxis, restaurants, hospitals, schools, and government agencies all accept payments through smartphones. In fact, it is common to see people using their phones to pay for items as small as a bottle of water or a steamed bun. In some cases, even individuals experiencing homelessness have adapted by displaying printed QR codes to receive digital donations. This pervasiveness has created a society where physical money is not just unnecessary—it is increasingly unwelcome. Many establishments no longer accept cash, and some have no infrastructure in place to handle it.

One of the unique aspects of China’s cashless system is the way it has been integrated with social and administrative functions. WeChat, for example, is not just a communication tool but also a portal to services such as booking medical appointments, paying traffic fines, filing taxes, and even accessing government subsidies. Alipay, on the other hand, offers users access to a range of financial products including insurance, loans, and a social credit scoring system called Zhima Credit, which can influence one's ability to rent apartments, access certain jobs, or travel without restrictions.

Offline code scanning payments refer to transactions completed by scanning static or dynamic QR codes at physical points of sale (POS), often through platforms like Alipay and WeChat Pay.

These transactions are typically:

Conducted in-person without the need for physical cards or cash

Authenticated through mobile devices

Instant and low-cost, benefiting both merchants and users

Transaction Value Growth (2020–2027)

In China, mobile payments have long exceeded the realm of e-commerce and found their way into every facet of commerce. From purchasing goods online and offline to transactions between friends and family, people mostly rely on the two market leaders WeChat Pay and Alipay to make transactions. The two mobile payment platforms belong to internet giants Tencent and Alibaba.

In addition to private mobile payment platforms, the Chinese government is also developing a state-backed digital currency known as the Digital Yuan, or e-CNY. This central bank digital currency is being piloted in several cities and is designed to reduce the dominance of private tech companies in the financial sector while giving the government greater oversight over the economy. The Digital Yuan is programmable, meaning it can be coded with features such as expiration dates or restrictions on how it can be spent—tools that could be used for targeted economic stimulus or social control.

While the benefits of China’s cashless society are considerable—such as convenience, reduced crime, and improved financial inclusion—they are accompanied by significant concerns. The integration of mobile payments with government systems and surveillance infrastructure means that transactions can be easily tracked. In a society where political expression is tightly controlled, this raises fears about the erosion of privacy and personal freedoms.

Here's a look at the estimated transaction values (in CNY trillions) for offline code scanning payments in China:

| Year | Transaction Value (CNY ¥ Trillions) | Highlights |

|---|---|---|

| 2020 | ~25.5 | Contactless payment surged during COVID-19 |

| 2021 | ~34.0 | Widespread adoption in rural areas |

| 2022 | ~41.0 | Small and medium-sized businesses integrate QR payments |

| 2023 | ~47.5 | QR payments become standard across industries |

| 2024 | ~53.0 (est.) | Tech innovation: QR + biometrics & 5G rollout |

| 2025 | ~58.0 (est.) | Strong microtransaction growth & rural penetration |

| 2026 | ~62.0 (est.) | AI-enhanced fraud prevention and payment trust |

| 2027 | ~65.0 (est.) | Market maturity with focus on value-added services |

Data based on research from iResearch, Statista, and PBOC reports. Figures are estimates and may vary across sources.

What’s Driving the Growth?

While many countries still struggled to promote mobile payments in response to the COVID-19 pandemic, China was already leading the rest of the world in building up a cashless society. The country was leading in user numbers and penetration rates and more than half of the Chinese population uses mobile payments each quarter. Over the years, Alipay and WeChat Pay have ruled the online payment market in China. The country's vibrant FinTech industry also brought about a flourishing e-commerce sector.

Several key factors have contributed to the exponential rise of China’s cashless society. Each of these elements has played a crucial role in shaping a financial ecosystem where digital transactions are not only common but have become the norm.

First and foremost is the ubiquity of smartphones. In urban China, smartphone penetration is now close to 100%, and even in rural areas, access is increasing at a rapid pace. These devices are no longer considered luxury items but essential tools for everyday life. With smartphones in nearly every pocket, mobile payment systems have found an ideal foundation for widespread adoption. Users, regardless of age or socioeconomic status, can easily access apps like Alipay and WeChat Pay, which have made digital transactions seamless and intuitive. The hardware infrastructure is already in place, and the user familiarity with mobile apps has eliminated the learning curve that might have otherwise hindered adoption.

Secondly, the dominance of two major platforms—Alipay and WeChat Pay—has significantly contributed to the normalization of mobile payments. These applications go far beyond simple payment tools. They are embedded into the very fabric of daily life in China. Alipay, developed by Ant Group, offers everything from loans and investment products to utility bill payments. WeChat Pay, integrated into the massively popular WeChat messaging app, allows users to transfer money, make purchases, split restaurant bills, and even pay for transportation without leaving the app. Their widespread presence and reliability have made them trusted, indispensable tools for millions. Importantly, their use of QR code technology for payments ensures transactions are quick, efficient, and compatible with virtually all merchants, from major retailers to informal street vendors.

Government support has also played a pivotal role in the growth of China’s cashless economy. Rather than resisting this shift, Chinese authorities have actively encouraged it. The People’s Bank of China (PBoC) and other regulators have issued clear guidelines and standards to ensure interoperability and security across payment platforms. At the same time, the government has championed the development of the digital yuan (e-CNY), a state-issued central bank digital currency (CBDC). This initiative underscores the state’s ambition to enhance control over the financial system while providing citizens with more efficient access to public services and payments.

The COVID-19 pandemic further accelerated the shift to cashless transactions. With concerns over the spread of the virus through physical contact, consumers and merchants alike turned to digital payments as a safer alternative. Contactless transactions, particularly those involving QR code scanning, quickly became the preferred method in physical stores, restaurants, and public transport systems. The pandemic served as a catalyst that pushed even the most reluctant users into adopting mobile payments, solidifying habits that have persisted beyond the crisis. In a country already primed for digital transformation, this public health emergency fast-tracked the journey toward a cashless society.

Technology Trends in QR Code Payments

In addition to the widespread adoption of mobile payment systems, several advanced technologies and innovations have been implemented in China to enhance the security, reliability, and inclusiveness of its cashless economy. These innovations are critical to ensuring that the system remains not only efficient but also trustworthy and accessible to all segments of society.

One major development is the use of encrypted and dynamic QR codes to prevent fraud. In the early days of mobile payments, static QR codes were vulnerable to tampering. For example, malicious actors could replace a vendor’s code with one that redirected payments to a different account. To address this, platforms like Alipay and WeChat Pay began introducing dynamic QR codes that change with every transaction. These codes are encrypted and generated in real time by the payment app, making them much harder to forge or intercept. Additionally, dynamic codes often include metadata about the transaction—such as amount, time, and location—which can be cross-checked for authenticity. This innovation significantly reduces the risk of fraud, giving both merchants and consumers greater confidence in using digital payments.

Offline QR code payment support has also been a game-changer, particularly in areas with poor or unreliable internet connectivity. In rural regions or underground transit systems where real-time internet access may be limited, users can still make payments using pre-generated QR codes that store temporary authorization data. When connectivity is restored, the transaction is automatically processed and synchronized with the user’s account. This feature ensures that mobile payments are not limited to urban environments with strong network coverage. It also makes digital transactions more resilient in emergencies or network outages, extending the reach of the cashless economy to nearly every corner of the country.

Artificial intelligence (AI) has also played an important role in enhancing the safety and efficiency of mobile transactions. Leading payment platforms deploy AI-powered systems to detect suspicious behavior in real time. These systems analyze patterns of user activity, such as unusual spending locations, rapid transaction spikes, or inconsistent login behavior. When anomalies are detected, the platform can automatically impose temporary holds, request identity verification, or trigger alerts to the user. Furthermore, smart spending limits can be set based on the user’s financial history, transaction frequency, or risk profile. By adapting to user behavior dynamically, AI ensures that the system can scale securely and handle billions of transactions without overwhelming human oversight.

Lastly, hybrid identity verification models that combine QR codes with biometric authentication—particularly facial recognition—are being introduced for added security and speed. In some high-security or high-volume environments, such as train stations or hospitals, users can authenticate a transaction by simply scanning a QR code and having their face verified at the same time. This dual-layer method not only speeds up the verification process but also deters impersonation and account theft. In cities like Hangzhou and Shenzhen, facial recognition kiosks have already been installed in convenience stores and subway stations, enabling fully automated purchases without the need to touch a screen or pull out a phone. Though concerns about privacy and surveillance remain, this hybrid approach reflects China’s commitment to merging efficiency with cutting-edge security.

China's Influence on Global Trends

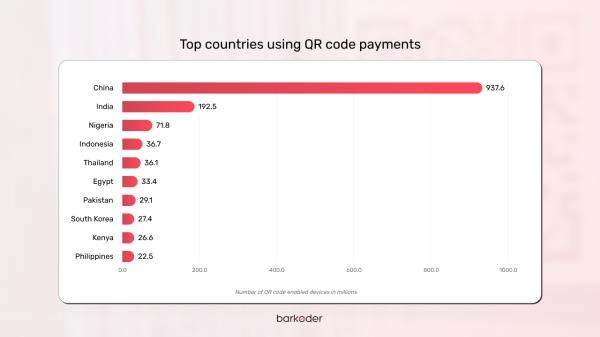

China’s dominance in offline QR payment infrastructure is not only reshaping its own domestic economy—it is also inspiring similar growth across developing regions in Southeast Asia, Africa, and Latin America. In many of these regions, where traditional banking infrastructure is limited and a large portion of the population remains unbanked or underbanked, low-cost, mobile-first solutions are not just preferable—they are essential. The success of China’s mobile payment model, particularly its use of simple yet powerful QR code technology, offers a practical blueprint for nations seeking to leapfrog conventional banking systems and embrace digital financial inclusion.

Countries like India, Thailand, and Brazil are leading this trend, each developing national payment systems inspired by China’s innovations. In India, the Unified Payments Interface (UPI) has transformed how people send and receive money, and QR code-based payments have become ubiquitous in both urban and rural markets. Much like China’s system, UPI allows real-time transfers and is widely supported by mobile wallets, banks, and government initiatives. Thailand has developed its PromptPay system, a real-time payment platform that incorporates QR code functionality and has seen rapid uptake among small businesses and consumers. Similarly, Brazil’s Pix system, launched by the Central Bank of Brazil, allows instant payments and leverages QR codes to enable fast, cost-free transactions for both individuals and merchants.

In Africa, mobile money services like M-Pesa in Kenya laid the groundwork for digital finance, but Chinese fintech companies are now playing a growing role in expanding QR-based payments. For example, Chinese firms have partnered with local businesses in Nigeria and South Africa to introduce mobile payment services modeled on Alipay and WeChat Pay, complete with offline capabilities. These systems are particularly valuable in areas with unreliable internet access, where offline QR functionality ensures that transactions can be completed even in the absence of real-time connectivity.

Latin American countries are also beginning to adopt similar models. In Mexico and Colombia, financial authorities are rolling out interoperable QR code systems that can unify fragmented digital payment platforms. These developments are often driven by the same goals that China pursued: reducing cash dependency, formalizing the informal economy, improving tax collection, and fostering financial inclusion for millions of people who have never had access to traditional banking.

China’s export of mobile payment technology is not just about infrastructure—it also includes strategic partnerships, investments, and knowledge sharing.

In summary, China’s leadership in QR-based mobile payment infrastructure has become a global reference point for developing nations seeking fast, inclusive, and cost-effective digital financial systems. By exporting both technology and experience, China is influencing the shape of global digital finance—especially in regions where traditional banking has fallen short. This global diffusion of QR-based payment models represents not only a technological trend but also a powerful force for economic empowerment and financial modernization in the Global South.

What to Expect by 2027

China’s transition to a nearly cashless society is a striking example of how technology can transform a nation’s economic and social fabric. It offers a vision of efficiency and convenience that many other countries may seek to emulate. At the same time, it presents a cautionary tale about the potential costs of such transformation, particularly in terms of privacy, autonomy, and inclusiveness. As China continues to refine and expand its digital finance systems, the rest of the world is watching closely—both to learn from its innovations and to reflect on the deeper implications of a cashless future.

By 2027, China’s offline QR code payment market is expected to exceed ¥65 trillion. While the rate of growth may begin to plateau, the focus will shift toward:

Enhancing security

Improving cross-border functionality

Embedding payments into more everyday services

Supporting inclusive finance in underserved regions

Final Thoughts

China’s journey with offline code scanning payments is a remarkable case of technology adoption at scale. As QR payments become faster, smarter, and more secure, they’re setting the global standard for how mobile-first economies can flourish.

For businesses, developers, and fintech providers, keeping an eye on China’s innovation in this space isn’t just interesting—it’s essential.

China’s nearly cashless society stands as a powerful illustration of how digital technology can rapidly reshape everyday life. Through the widespread use of mobile payment platforms like Alipay and WeChat Pay, financial transactions have become faster, more convenient, and deeply embedded in both commercial and social systems. The rise of the Digital Yuan further signals China’s commitment to a fully digital economy under increased state oversight.

However, this transformation is not without consequences. While many enjoy the benefits of a frictionless, high-tech payment system, others face exclusion due to lack of access or digital literacy. More importantly, the deep integration of financial data with government systems raises serious concerns about surveillance, privacy, and individual freedom.

Want to integrate QR code scanning into your own app?

At barKoder, we provide a high-performance, cross-platform barcode scanning SDK that’s optimized for real-time code scanning—including QR codes, MRZs, and more. Get in touch with us to learn how we can help power your next generation of scanning apps.

The new version of our SDK can be obtained by registering on the barKoder Developer Portal and visiting our Repository sub-page. Each registered account can utilize the self-service for generating a completely free trial license for an initial duration of 30 days that will grant you a full run to evaluate the capabilities of our mobile & web barcode scanner SDK for up to 25 devices. If your project has somewhat different requirements, we'll be happy to hear from you.