Qr code payments in Japan statistics and facts.

Payments using QR technology

QR code scans in 2023 reached 26.95 million, marking a 433% increase over the past two years

The latest QR code statistics report revealed a staggering 26.95 million scans worldwide across all channels. The primary driver of the QR code surge is smartphone usage. With 7.1 billion global smartphone users this year, there is a clear demand for mobile-first technology such as QR code scanning. User-generated dynamic QR Codes amassed a total of 6,825,842 scans from global users, marking a 433% increase over 2021 figures.

As of April 2024, the top 10 countries with the highest scanning activity are:

- United States – 38.17%

- India – 9.11%

- Mexico – 3.90%

- France – 3.86%

- Spain – 3.14%

- Saudi Arabia – 2.75%

- Turkey – 2.66%

- United Kingdom – 2.10%

- Russia – 1.95%

- Canada – 1.63%

A Statista report from 2022 has revealed that around 89 million smartphone users in the US utilized their devices to scan QR codes, marking a 26% increase from 2020. It is anticipated that this number will surge by an additional 16 million users by 2025.

QR code payments in Japan - statistics & facts

According to Statista the use of QR Code payment services in Japan has significantly increased in recent years. This growth has been driven by the government's cashless rebate campaign and the rise in digital payment usage during the COVID-19 pandemic. As a result, QR code payments have surpassed electronic money to become the second most popular cashless payment option.

In the fiscal year 2021, Japan's code-based mobile payment market reached 9.46 trillion Japanese yen. The market is expected to grow to 19.76 trillion yen by fiscal 2026.

Code-based payments involve the use of QR Codes or barcodes for payments, where users scan a merchant's code with their smartphone, or a merchant uses a device to scan a customer's code.

Could you explain what QR code payment services are?

QR code payment services allow users to pay for goods and services by scanning a store's barcode or QR code with their smartphones utilizing the pre-build cameras via mobile barcode scanning technology. Users can either scan a code provided by a merchant or have the merchant scan their code (consumer-presented and merchant-presented modes).

This service doesn't require additional devices like payment terminals, making it an appealing option for small retailers. QR code payment services can be linked directly to a bank account or credit card, or users can use them as a prepaid payment method. Some providers also offer peer-to-peer money transfers, which have seen significant growth in recent years. QR code payments are gaining popularity in Japan, with a transaction value of almost 15 trillion Japanese yen. In 2022, QR code payments surpassed electronic money, based on NFC technology, to become the second-most used payment method in Japan.

The rapid ascent of QR code payment services

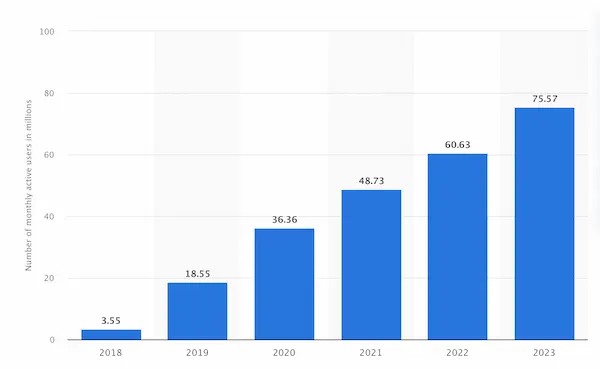

LINE Pay was launched in 2014 and was one of the first QR code payment services in Japan. In 2019, the acceptance of QR code payments increased significantly, a year after PayPay and D Barai began their services. The expansion of QR code payment services was supported by a large-scale cashless reward program by the government, which was introduced alongside an increase in consumption tax. Additionally, new payment providers aggressively competed for market share with reward campaigns and an initial phase of zero merchant fees. During this time, merchants also started offering QR code payment options from overseas providers like Alipay and WeChat Pay to attract inbound tourists. From 2018 to 2023, the number of monthly active QR code payment service users increased from 3.55 million to a staggering 75.8 million. PayPay, with 56.6 million registered users, is among the largest QR code payment providers, along with Rakuten Pay and D Barai.

In 2019, Japan introduced a standardized QR code called JPQR to enable the use of one single QR code for all participating payment providers. Japan also wants to make its system compatible with that of a number of Southeast Asian countries by 2025.

Japan and ASEAN plan to introduce a collaborative QR code payment service in FY2025

From 2025, Japan and the Association of Southeast Asian Nations (ASEAN) will be introducing a unified QR code payment system, according to the Nikkei Asia citing Japan’s Ministry of Economy, Trade and Industry (METI).

The goal of this initiative is to simplify transactions between these countries by eliminating the need to exchange currency, which can be time-consuming, especially for tourists. The ministry is currently in talks with governments and central banks of various countries, including those in Southeast Asia, to facilitate this process.

The Cashless Promotion Council is working on developing a payment system that will connect domestic and international services. This system is expected to be operational by 2024. While QR code payment services are already available in Japan through platforms like Paypay and Rakuten Pay, the current system only applies to registered services. The new unified system aims to enable consumers to pay for any type of service using their smartphones.

According to TechinAsia and NikkeiAsia additionally, five ASEAN member countries – Singapore, Indonesia, Thailand, Malaysia, and the Philippines – signed a memorandum of understanding in 2022 to integrate payments between their countries and have since made progress in various areas.

Furthermore, Japan plans to negotiate with ASEAN countries to implement this unified payment system, as per the report.

As of 2022, non-cash payments in Japan amounted to about 111 trillion yen (approximately $750 billion), with QR codes and other codes accounting for just 2.6% of these payments, according to METI. On the other hand, digital payments in six major Southeast Asian countries totaled $858 billion in 2022, as per Google statistics.

A survey conducted by Fidelity National Information Services (FIS) indicated that digital payments, including QR codes, make up 28% of total payments in Indonesia and 23% in Thailand. Other surveys also show that users in Thailand have used QR payment methods in great numbers since 2020.

QR Code payment services and the barKoder API

Taking in mind that mobile-based barcode scanning software is essential to making QR Code payment services function, the barKoder Barcode Scanner SDK has strategically placed itself in the forefront of the software barcode scanning market, powered by its MatrixSight® technology that captures the data from virtually any QR Code, even those missing their alignment or timing patterns. The barKoder barcode API is available for virtually any development platform and framework, be that native Android & iOS, Windows, Linux, Web, Flutter, React Native, Capacitor, Xamarin, Cordova, NativeScript or .NET Maui.

Leading in terms of reading rate and overall performance over virtually any competitor product, barKoder provides the highest ROI for any project.